Compound interest calculator for yearly deposit

To calculate the future value of a monthly. Ad Learn How Our Online Tools Can Help Answer Your Important Financial Questions.

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Calculate the impact of dividend growth and reinvestment.

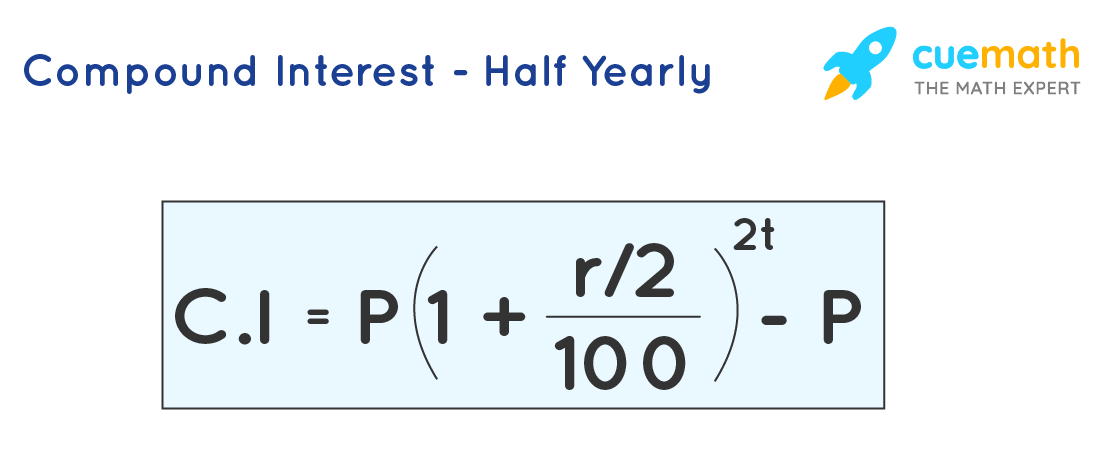

. P the principal the amount of. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. The compound interest formula solves for the future value of your investment A.

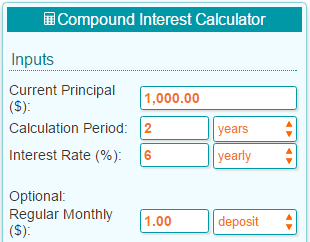

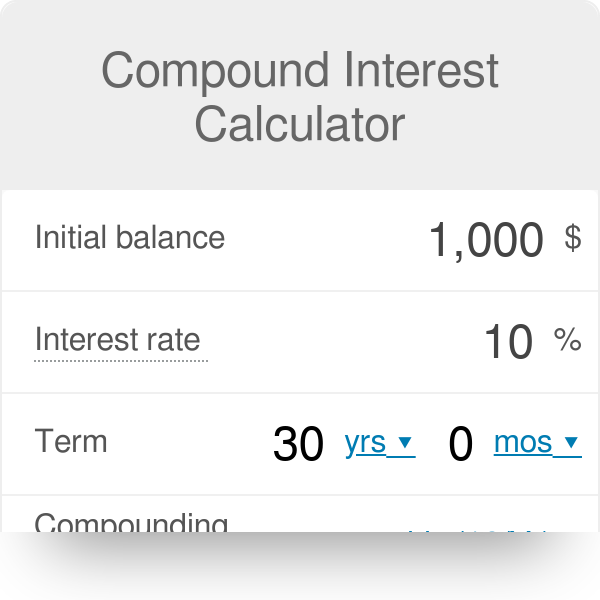

This calculator will help you to determine the future value of a monthly investment at various compounding intervals. The capital growth rate is a straightforward. Then enter the time period for which.

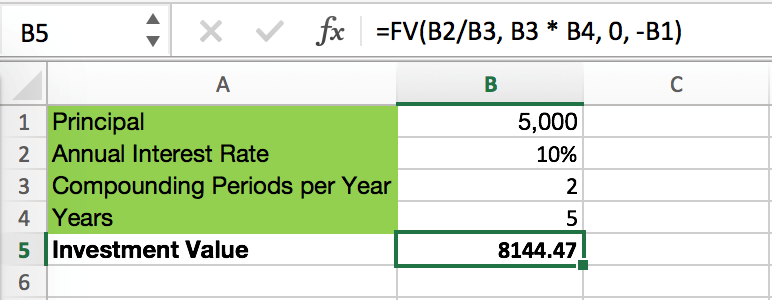

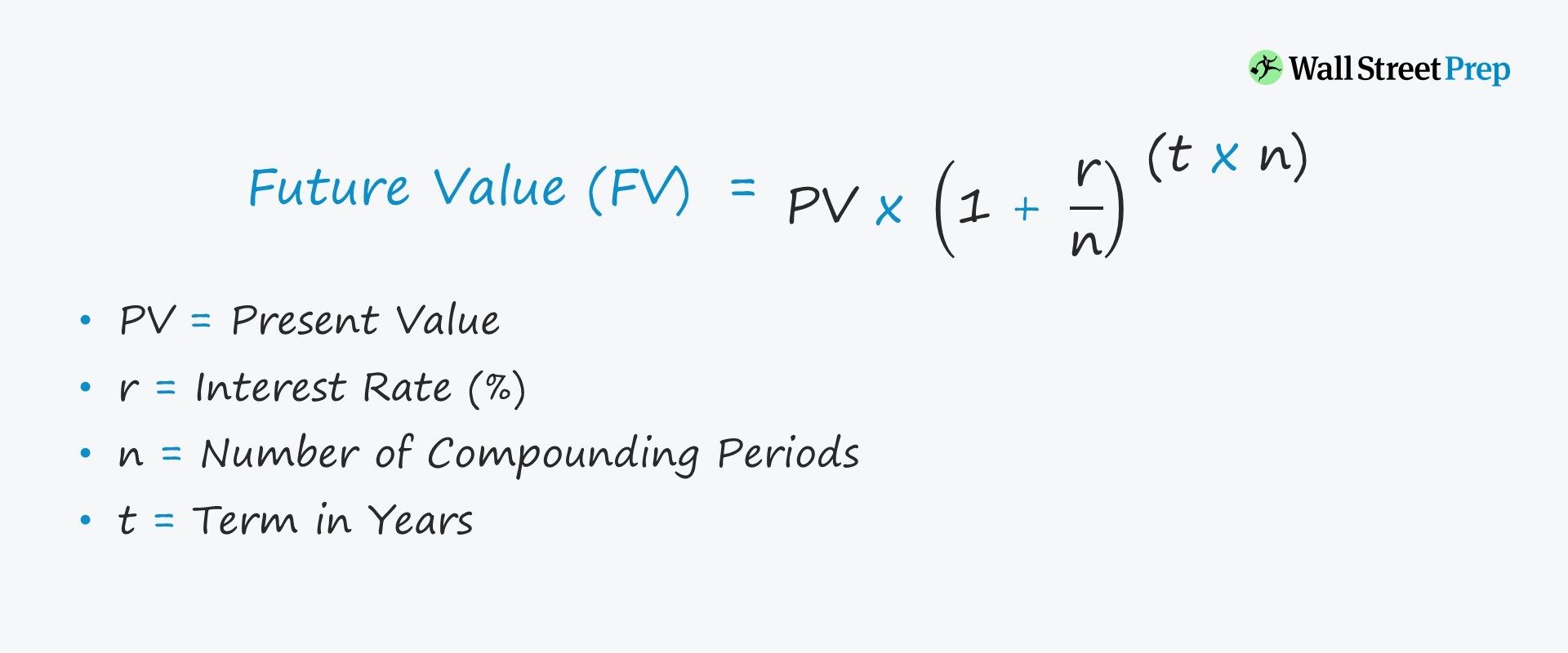

The formula for Compound Interest Calculator with Additional Deposits is a combination of. Over the long term compound interest can greatly increase investment returns. We want to calculate the amount of money you will receive from this investment that is we want to find the future value FV of your investment.

Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Also select how the interest will be compounded. To count it we need to plug in.

Deposit what works best for you. Monthly quarterly or yearly. For example lets say you deposit 2000 into.

How Interest is Compounded. Ad Our Resources Can Help You Decide Between Taxable Vs. Specify the initial investment with your plans for.

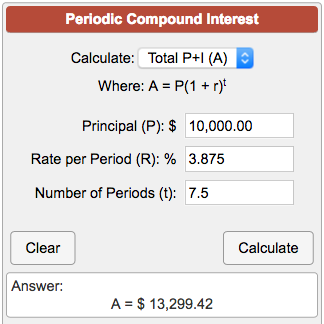

Understanding the concept of compounding can benefit you hugely. In the calculator above select Calculate Rate R. The Certificate of Deposit Calculator uses the following formulae.

Use this compound interest calculator to illustrate. We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. Compound Interest Calculator Savings Account Interest Calculator.

Our compound interest calculator will help you discover how your money could grow over time using the power of compounding interest. But by depositing an additional 100 each. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued.

FV D 1 r n nt. We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. TIAA Can Help You Create A Plan For Your Future.

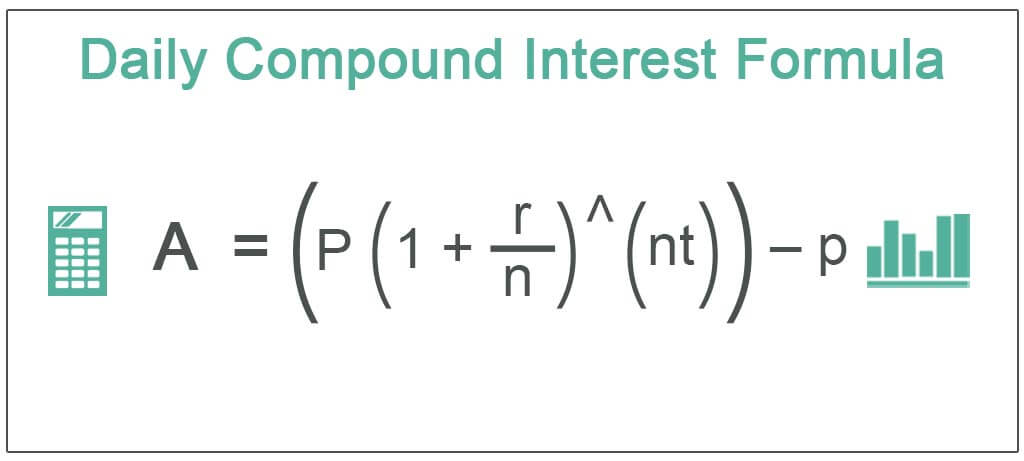

Every Capital One 360 CD balance is insured up to the FDICs allowable limits. Here is how compound interest is calculated for. A P 1 rnnt.

For example lets say you deposit 2000 into. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. By default it is selected to compounded yearly.

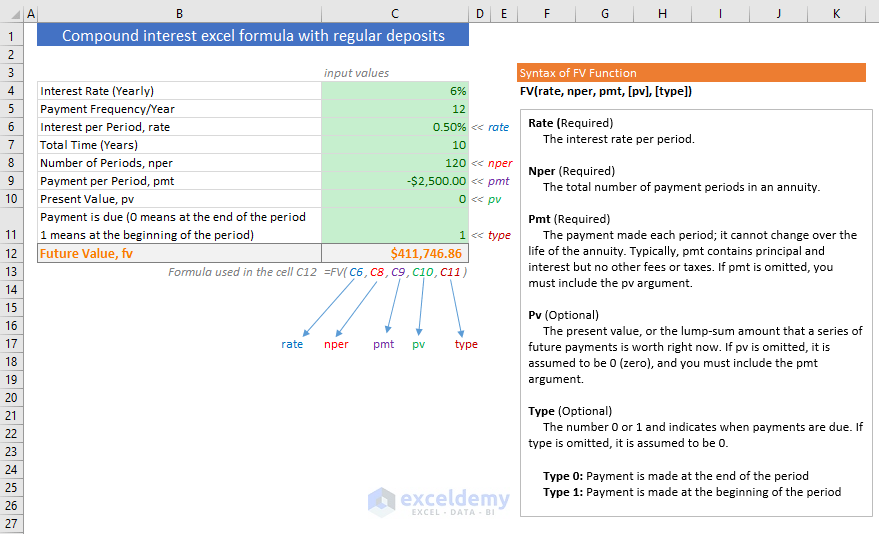

Ad Theres no minimum balance to open a CD account. Compound Interest Formula P 1rn nt and Future Value of Series Formula PMT 1. Ad Use Our Free Dividend Calculator to Calculate Compound Returns and Reinvestments.

Dont Wait To Get Started. So youd need to put 30000 into a savings account that pays a. The Deposit Interest Calculator.

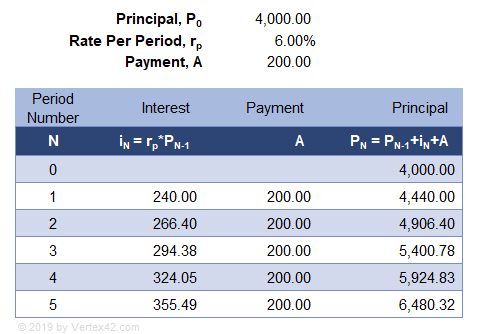

The detailed table shows at a yearly basis the deposit at beginning of the year interest total interest and final amount including interest at end of the year. While a 100000 investment earning 5 basic yearly interest would accrue 50000 in total interest over ten. Every Capital One 360 CD balance is insured up to the FDICs allowable limits.

110 10 1. The compound interest formula is. FV Future Value of the CD D Initial deposit amount r Nominal annual interest rate in decimal.

Even small deposits to a. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Enter a number of years or months or a combination of both for the.

R n AP 1nt - 1 and R r100. Use this compound interest calculator to help determine how much your savings will grow over the years. There are three options.

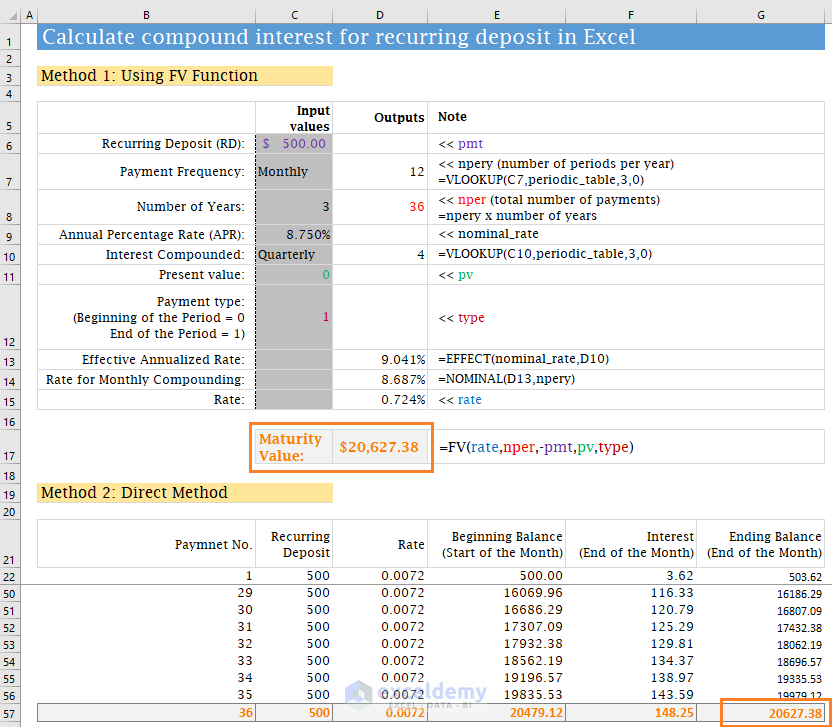

The calculator will use the equations. How to calculate compound interest for recurring deposits in Excel. Thus the interest of the second year would come out to.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Enter a percentage interest rate - either yearly monthly weekly or daily. Our calculator compounds interest each time money is added.

If the account has a lump-sum initial deposit does not have any periodic deposit by default. Enter an initial balance figure. Deposit what works best for you.

The interest on that is now not 200 like in year one but 10200 x 002 204 hence at the end of year two the deposit will be worth 10404. Ad Theres no minimum balance to open a CD account. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued.

See how compound interest can increase your.

Compound Interest Calculator For Excel

How To Calculate Compound Interest For Recurring Deposit In Excel

Compound Interest Formula In Excel And Google Sheets Automate Excel

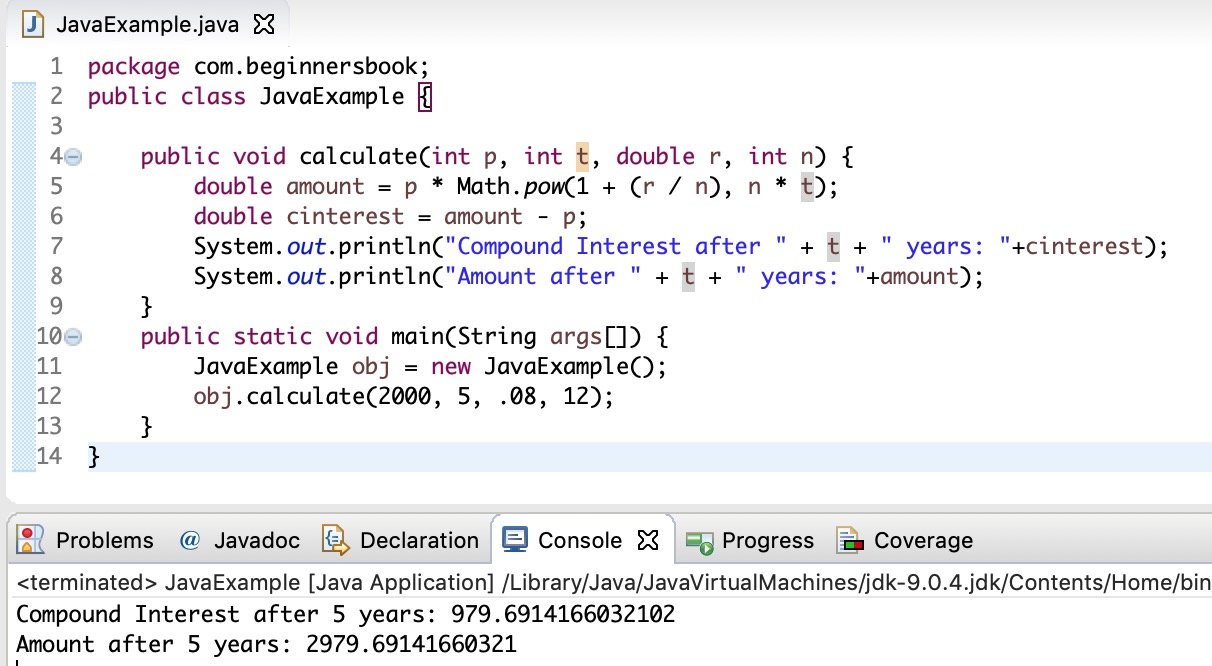

Java Program To Calculate Compound Interest

Compounding Interest Calculator Yearly Monthly Daily

Compound Interest Calculator For Excel

Compound Interest Formulas Derivation Solved Examples

Periodic Compound Interest Calculator

Compound Interest Formula And Financial Calculator Excel Template

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Excel Formula With Regular Deposits Exceldemy

Compound Interest Calculator Daily Monthly Yearly

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Definition Formula How It S Calculated

Daily Compound Interest Formula Step By Step Examples Calculation

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Calculator With Formula